|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

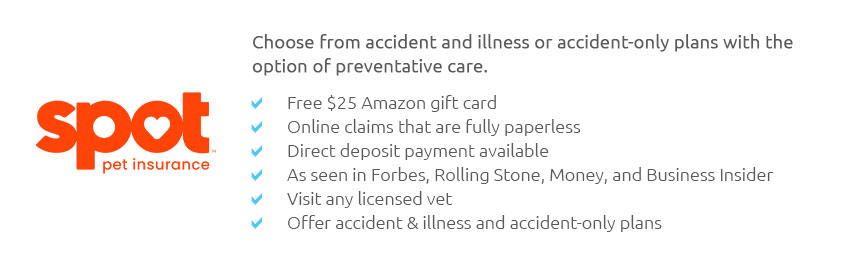

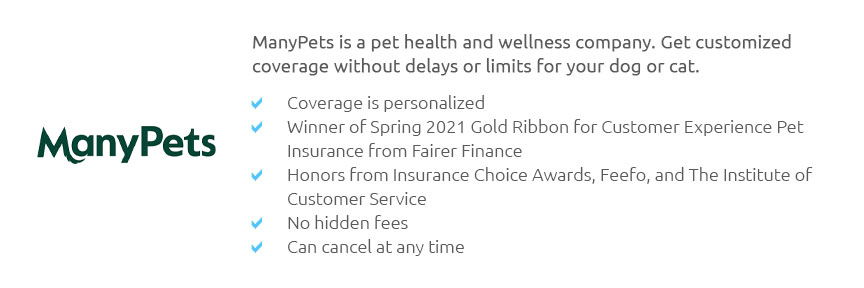

How to Compare Pet Insurance: A Comprehensive GuideIn today's world, where pets are considered cherished members of the family, ensuring their health and wellbeing through pet insurance has become increasingly popular. Yet, navigating the myriad of options available can be a daunting task. Understanding how to effectively compare pet insurance policies is essential to making an informed decision that suits both your pet's needs and your financial situation. Pet insurance policies, much like their human health counterparts, come in a variety of shapes and sizes, offering coverage for everything from routine check-ups to emergency surgeries. One of the primary considerations when comparing policies is the type of coverage offered. Typically, pet insurance can be broken down into three categories: accident-only, time-limited, and lifetime coverage. Accident-only policies, as the name suggests, cover injuries resulting from accidents and are generally the most affordable option. However, they do not cover illnesses or pre-existing conditions. Time-limited policies offer coverage for a set period, often 12 months, and are suitable for short-term needs but can become costly if your pet develops a chronic condition. Lifetime coverage, while more expensive, provides comprehensive protection and is ideal for pet owners seeking peace of mind. Another critical factor to consider is the excess and reimbursement level. The excess is the amount you pay towards a claim before the insurance kicks in, and policies with higher excess usually have lower monthly premiums. Reimbursement levels can vary, typically ranging from 70% to 100% of the vet bill. Selecting a policy with a higher reimbursement rate might seem advantageous, but it's important to balance this with the overall cost of the policy. Pre-existing conditions are another area of concern for many pet owners. Most insurers do not cover these conditions, which can be a significant drawback if your pet has a known medical history. It's advisable to thoroughly check the insurer's policy on pre-existing conditions and consider the implications on future coverage. Furthermore, consider the policy limits on payouts. Some insurers impose annual limits, while others set lifetime caps on how much they will pay out. Policies with higher limits or no caps are generally preferable, especially for breeds predisposed to certain health issues, but they come with a higher price tag. Customer service and claims processing are also pivotal elements in choosing the right pet insurance. Reading reviews and seeking feedback from other pet owners can provide insight into the insurer's reputation and reliability. An insurer with a seamless claims process can make a significant difference when you're dealing with a pet's health crisis. Moreover, as you compare pet insurance policies, consider any additional perks or services offered. Some insurers provide added benefits such as coverage for behavioral therapy, dental treatment, and even alternative therapies like acupuncture. While these extras can enhance your pet's overall care, they often come at a premium, so it's important to weigh their value against your pet's specific needs. In conclusion, while the process of comparing pet insurance policies may seem overwhelming at first, taking the time to thoroughly evaluate the options can lead to substantial long-term benefits. By considering factors such as coverage type, excess and reimbursement levels, pre-existing condition policies, payout limits, and customer service, you can select a policy that provides the best protection for your beloved pet. Remember, the goal is not only to find an affordable option but also one that offers comprehensive coverage, ensuring your furry friend receives the best possible care throughout their life. https://wagwalking.com/wag-wellness/pet-insurance

Wag! Compare is a free pet insurance comparison service and we help you compare the top insurance providers to get the best possible deal. https://www.trupanion.com/pet-insurance/pet-insurance-comparison

What's the best pet insurance coverage for your pet and budget? View side-by-side plan details and see how different pet insurance companies compare. https://www.akcpetinsurance.com/plans/compare-coverage

AKC Pet Insurance Leads the Pack. Pet insurance is an investment in your dog or cat's health and future, so choose the right provider for your pet's unique ...

|